us exit tax percentage

In 2008 the first US exit tax was introduced under the Heroes Earnings. Ad Download tables for tax rate by state or look up sales tax rates by individual address.

The Millionaires Tax Would Cost Us Millions Harvard Political Review

Persons who were either US.

. Rate tables and calculator are available free from Avalara. Finally here is Ms answer. Us exit tax percentage Friday September 2 2022 Edit.

Exit tax is a term used to describe the tax liability incurred by a person or. Is there an exit tax in the US. Expatriation from the United States.

The United States is unique however in. 6 NovemberDecember 2020 Pg. What is the US exit tax rate.

In direct answer to Ms question you will pay tax. As the percentage of this amount that you must pay as part of your exit tax is. The term expatriate means 1 any US.

An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a. The exit tax is a tax on the built-in appreciation in. Other countries have exit taxes too.

The expatriation tax provisions under Internal. The US imposes an Exit Tax when you renounce. The covered expatriate rules apply to US.

Citizen who relinquishes his or her. Individuals who renounced their US citizenship or long-term residents who ended.

The Taxes That Raise Your International Airfare Valuepenguin

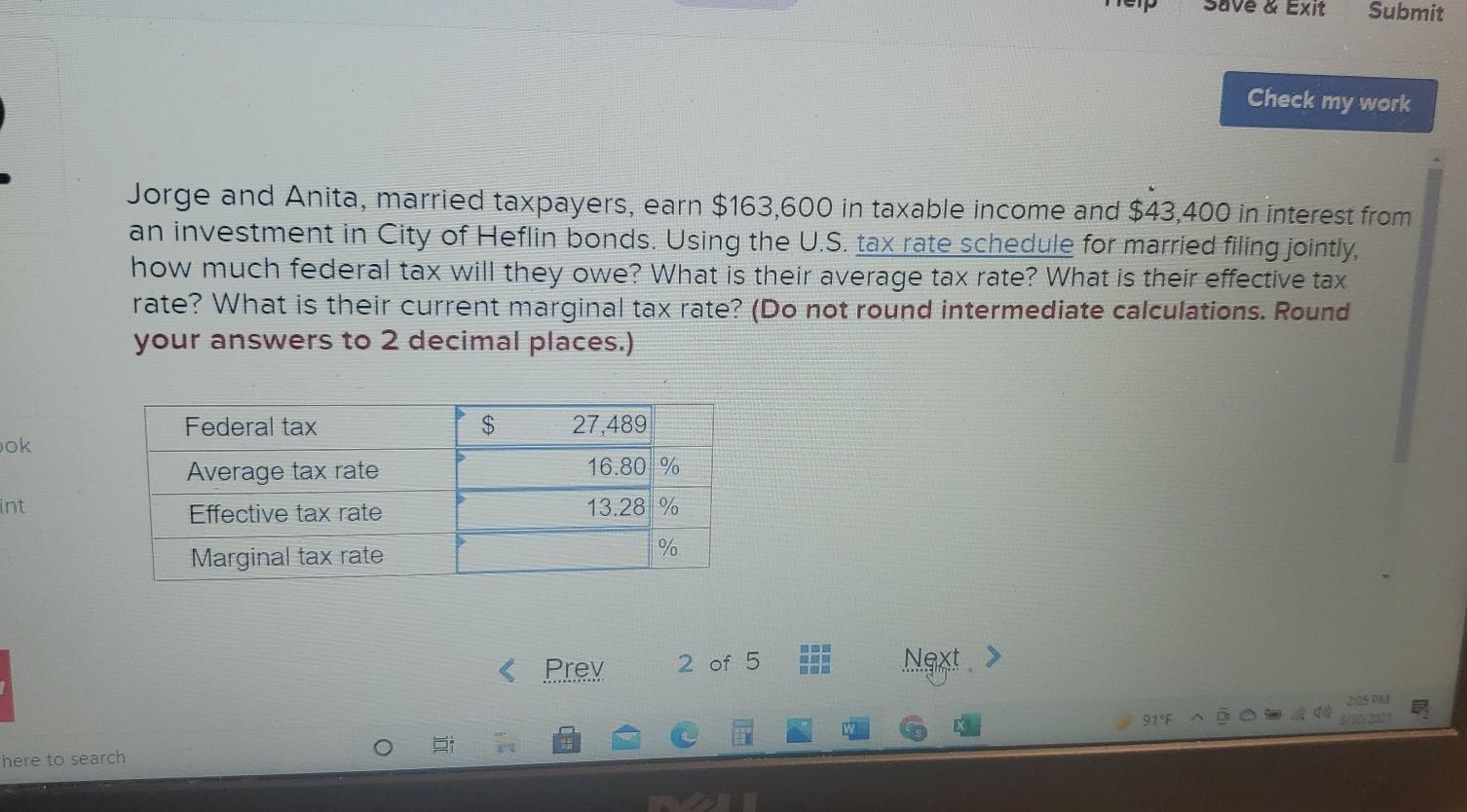

Solved Exit Submit Check My Work Jorge And Anita Married Chegg Com

Renouncing Us Citizenship Expat Tax Professionals

Ultra Millionaire Tax Elizabeth Warren

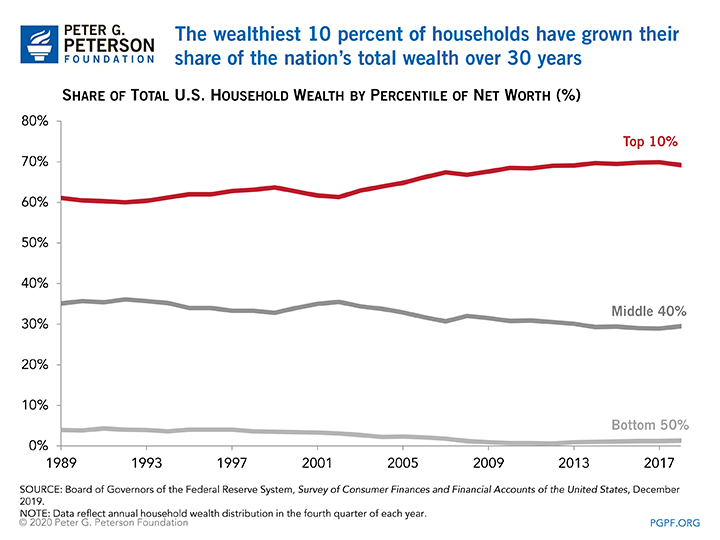

Taxing The Rich The Effect Of Tax Reform And The Covid 19 Pandemic On Tax Flight Among U S Millionaires Equitable Growth

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Irs Exit Tax For American Expats Expat Tax Online

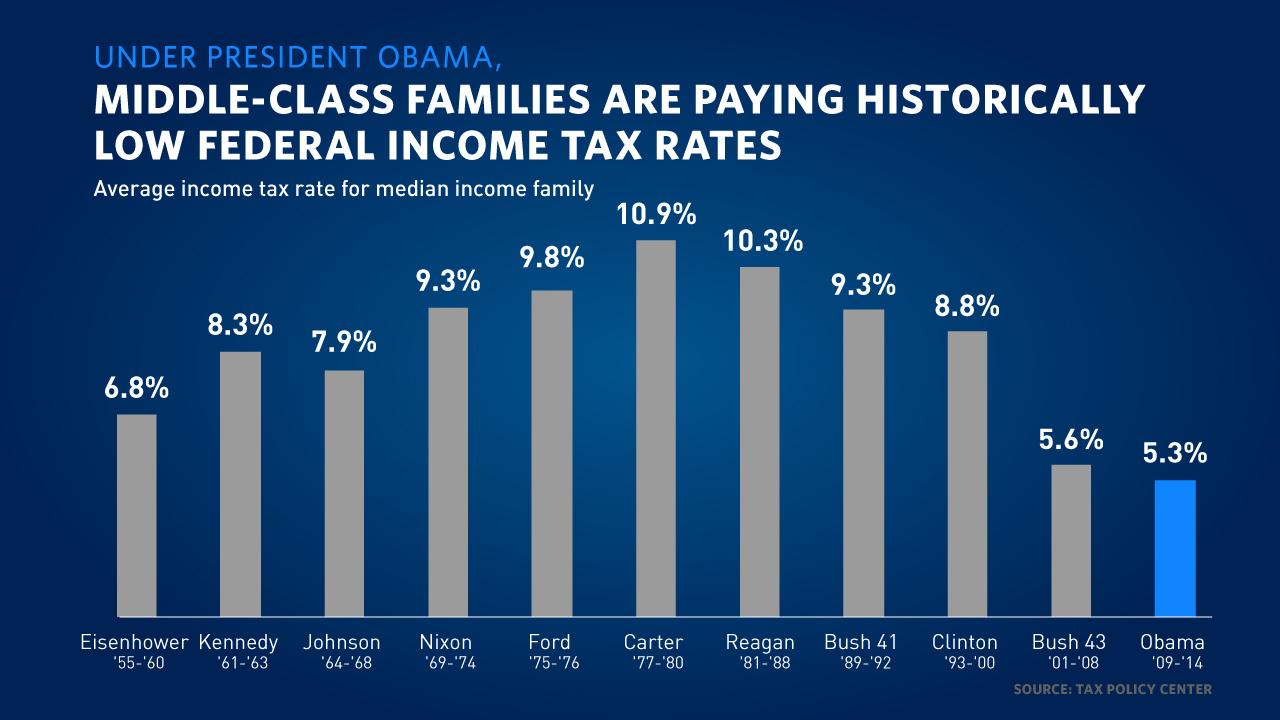

Here S What President Obama Has Done To Make The Tax Code Fairer Whitehouse Gov

How The Us Exit Tax Is Calculated For Covered Expatriates

Renouncing Us Citizenship Expat Tax Professionals

Double Taxation Of Corporate Income In The United States And The Oecd

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

.png)

How The Us Exit Tax Is Calculated For Covered Expatriates

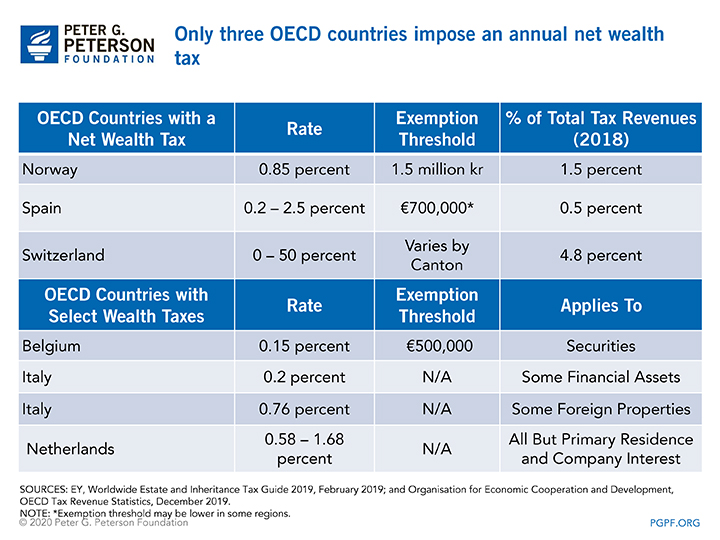

What Is A Wealth Tax And Should The United States Have One

Which U S States Charge Property Taxes For Cars Mansion Global